The Importance of Integrated Evidence Generation to Value Demonstration

Contributed by:

Faisal Latif

Head of Integrated Evidence Strategy

This is part 1 of a 3-part series on integrated evidence generation.

The life sciences industry is facing a once-in-a-generation set of external stressors.

Generational Stressors

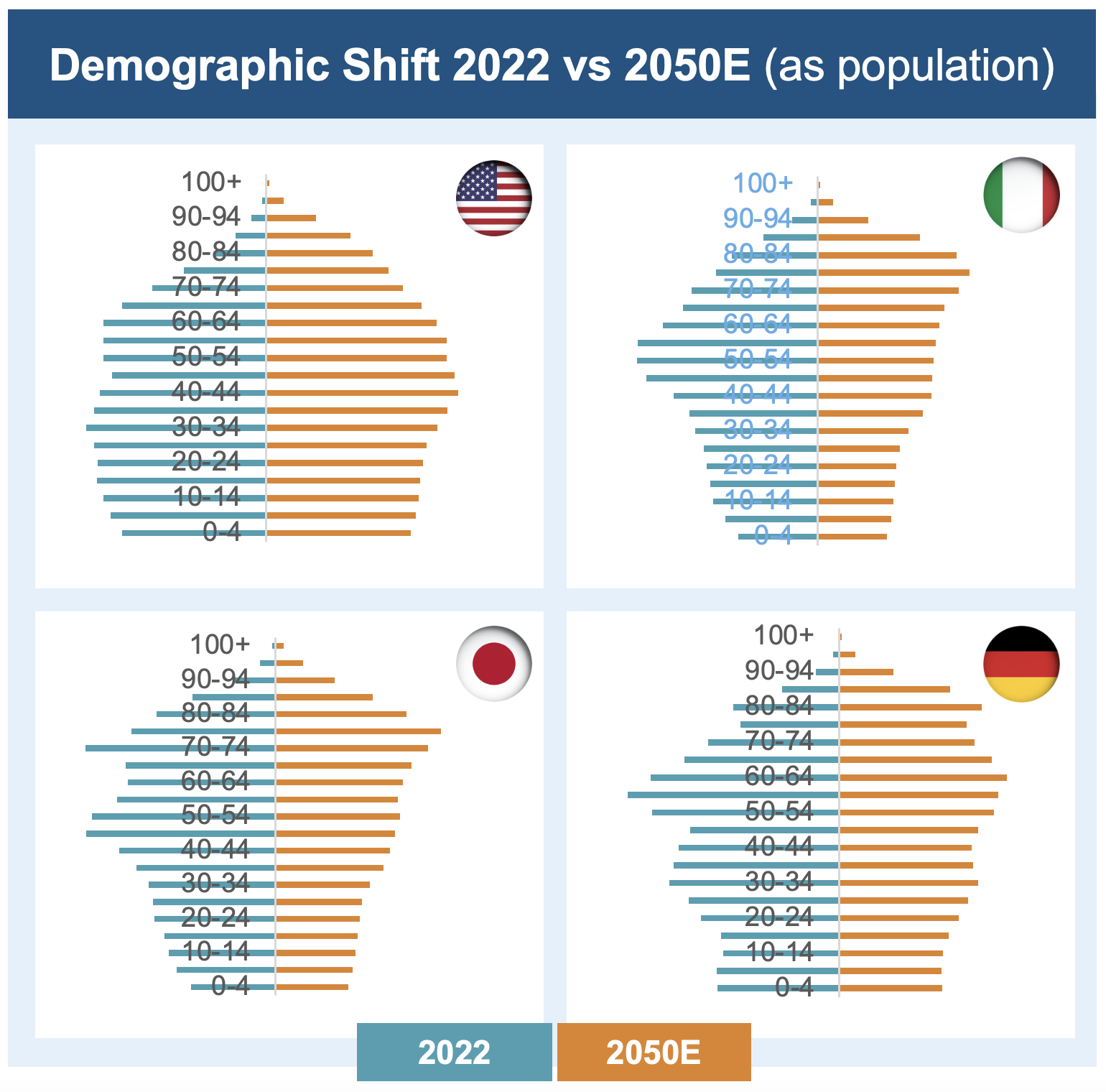

In many high-income countries, including Japan and Italy, we are seeing a demographic shift. As populations age and the proportion of working-age people decreases, societies are being placed under increasingly unsustainable economic strain.

Meanwhile, we continue to face economic uncertainty amidst global economic slowdown, with slow recovery following the COVID-19 pandemic and ongoing geopolitical instability in many parts of the world. In countries like the US, we are perhaps turning a corner, with some green shoots signalled by lower inflation and higher interest rates, but it is still early days. In the aftermath of the pandemic, there continues to be a trend towards deglobalisation, with an increased focus on self-sufficiency and resilience building across economies.

Finally, we continue to see increasing global health inequities within and among geographies, countries, and localities, with widening gaps in access, quality, and affordability of healthcare.

But what does all this mean for health systems and how have they responded to these external stressors?

Health System Reforms

Alongside the rising cost of living, the common denominator is the rising cost of healthcare. In response, health systems are undergoing reforms to contain healthcare spending; the pharmaceutical industry is, as usual, a target.

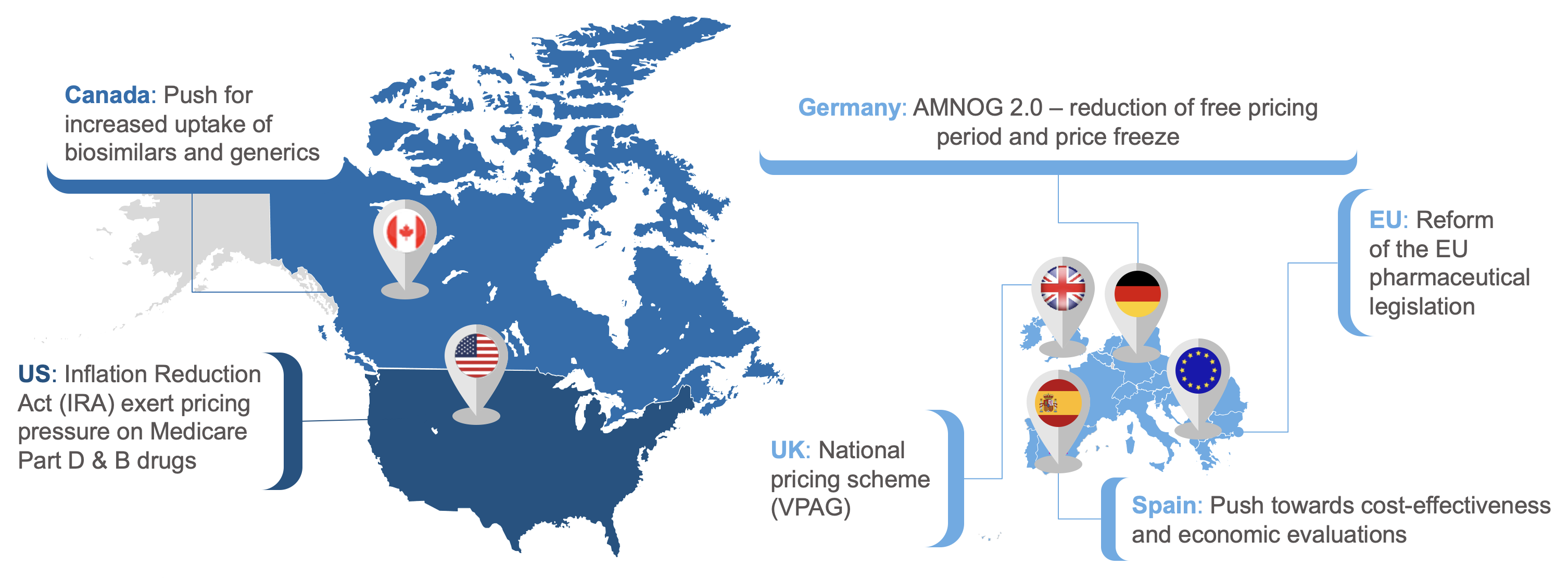

Currently, we are seeing major policy reforms to contain pharmaceutical spending:

- The Inflation Reduction Act (IRA) in the US recently set maximum fair prices for the first 10 chosen drugs, which will take effect in 2026,

- Reform of the EU Pharmaceutical Legislation and Joint Clinical Assessment across the European Union,

- Numerous national reforms to control medicines spending, including “AMNOG 2.0” in Germany, the 2024 Voluntary Scheme for Branded Medicines Pricing, Access and Growth (VPAG) in the UK, and ongoing drug pricing reforms in Japan, to name but a few.

This rising focus on cost containment has pushed the pharmaceutical industry to reprioritise its portfolios to ensure differentiation, placing even greater importance on evidence generation to demonstrate value.

We will dive into each of the above topics in depth over the coming weeks in this series of articles.

Life Sciences Innovators Can Lead the Change Via Integrated Evidence Generation

In the current volatile and highly competitive global pharmaceutical market, demonstrating value to support launch of medicines and therapeutics and manage their lifecycles has become more pertinent than ever before. Integrated evidence generation, as both an approach and a tool to achieve this, brings several benefits to the evidence-generation process, including:

- Accelerated timelines

- Enhanced efficiency

- Reduced costs

- Earlier cross-functional alignment and cohesion around a launch asset

Done well and in simple terms, integrated evidence generation has the potential to streamline the drug development process, with benefits unlocked for patients, healthcare systems, and innovators.

Future articles in this series will include examples of how industry leaders in this space, such as Eli Lilly, GSK, and Takeda, are effectively demonstrating the value of integrated evidence generation.